Improve Your Credit Score By 45 Points in as Little as 30 Days

Go from “Bad Credit” to Being Pre-Approved for Credit Cards, Loans, and Get Better Interest Rates that You Deserve!

GUARANTEED or You Don't Pay

Improve Your Credit Score By 45 Points in as Little as 30 Days

Go from “Bad Credit” to Being Pre-Approved for Credit Cards, Loans, and Get Better Interest Rates that You Deserve!

GUARANTEED or You Don't Pay

Our team is dedicated to helping you improve your credit score, SAVE MORE, pay off debt, and live life on your terms…

We’re Successful In Removing:

FORECLOSURES

STUDENT LOANS

LATE PAYMENTS

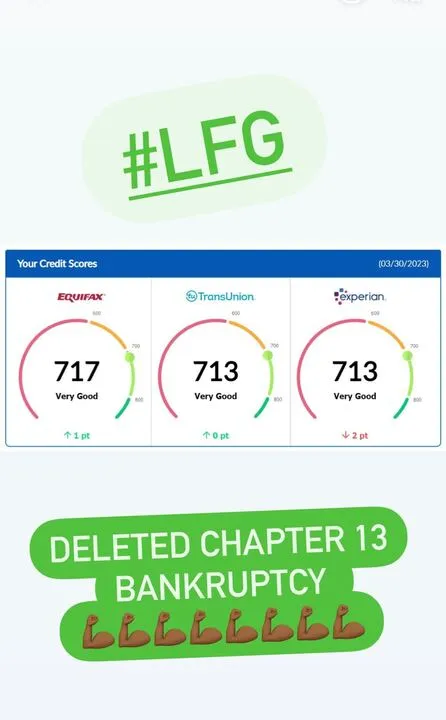

BANKRUPTCIES

COLLECTIONS

JUDGMENTS

REPOSSESSIONS

CHILD-SUPPORT

SHORT SALES

MEDICAL BILLS

PUBLIC RECORDS

HARD INQUIRIES

FORECLOSURES

STUDENT LOANS

LATE PAYMENTS

BANKRUPTCIES

COLLECTIONS

JUDGMENTS

REPOSSESSIONS

CHILD-SUPPORT

SHORT SALES

MEDICAL BILLS

PUBLIC RECORDS

HARD INQUIRIES

Here’s What You Can Expect…

Step 1: Sign Up

We give you a free credit consultation and analysis while we work with you to identify any negative items that are hurting your score.

Step 2: Dispute

We aggressive challenge negative items on your credit report with the credit bureaus and educate you on how to use credit properly to fast track your credit recovery.

Step 3: Track Progress

Every 30 days, we’ll update your encrypted portal with your credit improvement results sp you can see exactly what we’re doing and see real-time status updates.

Here’s What You Can Expect…

Step 1: Sign Up

We give you a free credit consultation and analysis while we work with you to identify any negative items that are hurting your score.

Step 2: Dispute

We aggressively challenge negative items on your credit report with the credit bureaus and educate you on how to use credit properly to fast-track your credit recovery.

Step 3: Track Progress

Every 30 days, we’ll update your encrypted portal with your credit improvement results so you can see exactly what we’re doing and see real-time status updates.

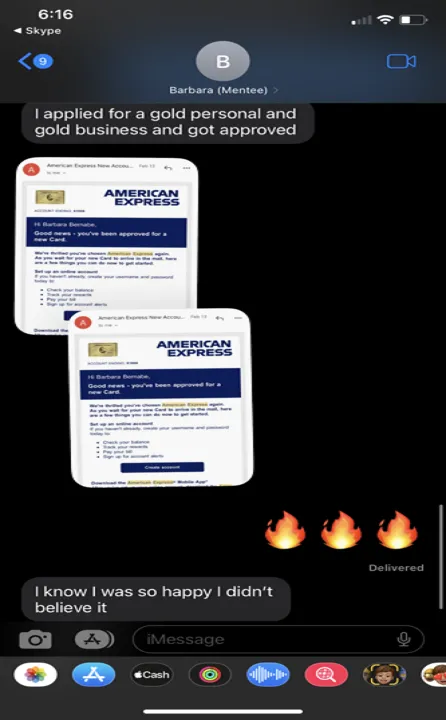

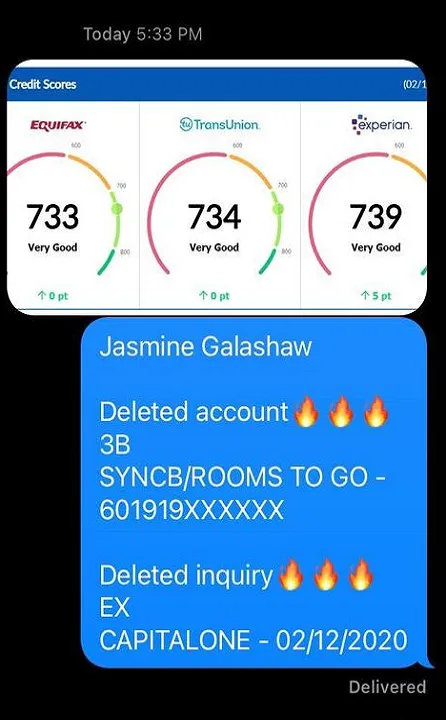

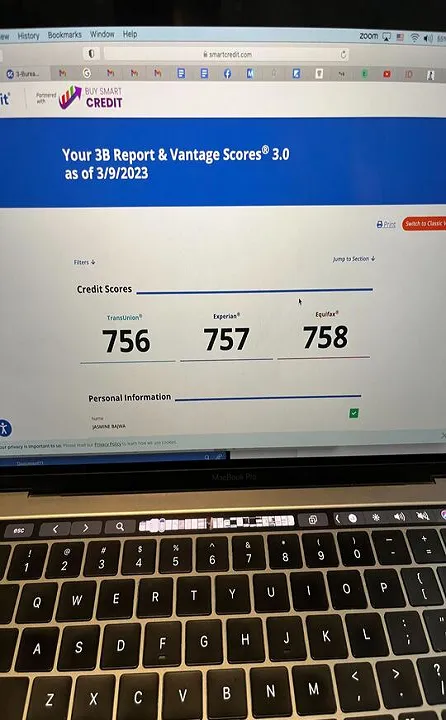

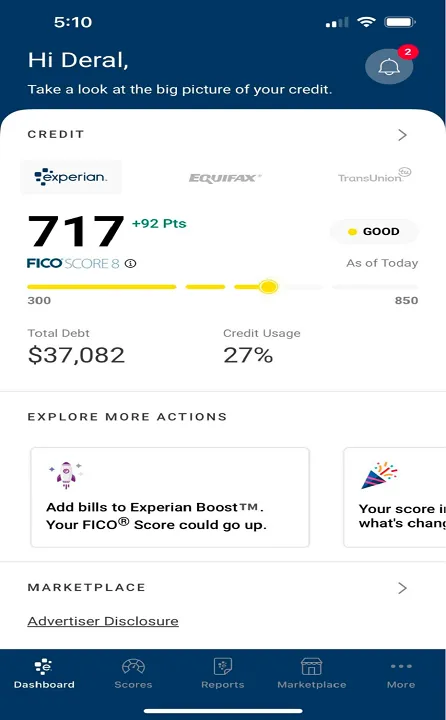

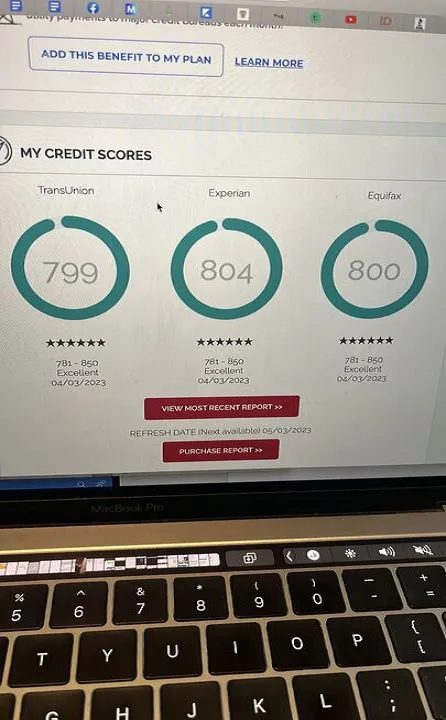

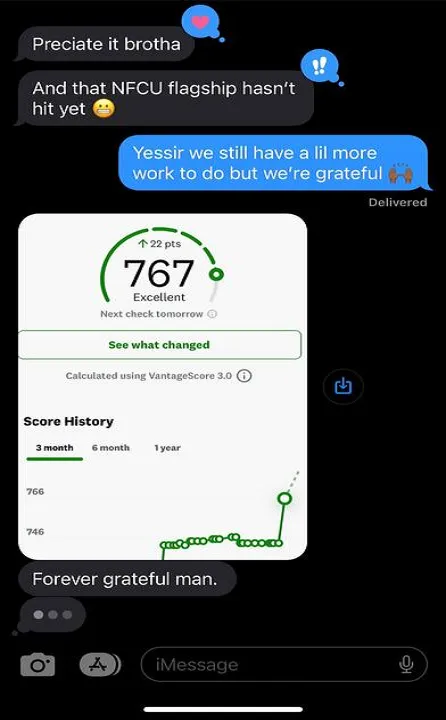

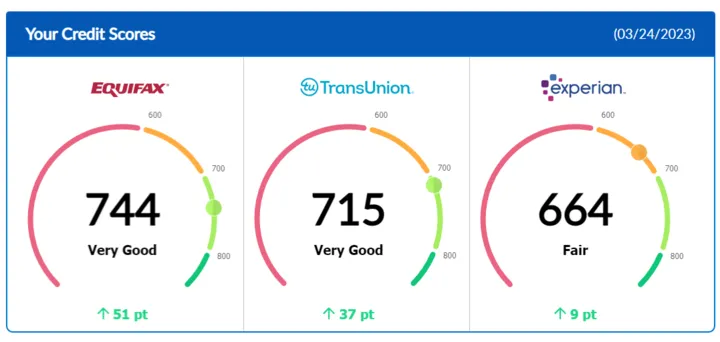

Check Out How We’ve Helped

Our Clients Improve their Credit Scores!

Frequently Asked Questions:

Can You Remove Anything From My Report?

Only items that fall under the guidelines of the FCRA and be disputed and removed. Generally, these are inaccurate, unfounded, out-of-date, false, and/or erroneous items that can be legally removed.

How Long Does This Process Take?

The process of improving credit varies case by case. Removing negative accounts may increase your score, however there are more factors at play that can potentially effect your credit score.

Factors that can impact your credit score are:

-Credit history

-Credit age

-Your payment history

-Your overall credit utilization

-The number of positive accounts on your credit profile

These factors have a huge influence on your score.

On average, our clients begin to see improvement within the first 14 days of signing up and a FULL recovery is typically between 30-90 days.

Can You Remove Late Payments?

Yes, we can! We have a late payment removal guide to help speed up the process of removing those late payments and boost your score.

We also can remove the following negative items from your report:

-Foreclosures

-Student loans

-Bankruptcies

-Collections

-Judgements

-Repossessions

-Child-support

-Short sales

-Medical bills

-Public records

-Hard inquiries

Can Removed Items Ever Show Up Again?

In most causes removed items do not return.

In the event that they do, collection agencies and credit bureaus MUST notify you before re-entering a previously removed item. While these agencies can transfer debts, you’ll have 30 days to respond.

In the event, however remote, that negative items reappear, we can remove them again promptly as they appear.

Connect With Us!

Sales:

(352) 604-4341

Customer Service and Client Payments:

(352) 604-4341

Email Us:

mrdmprice@thecreditking.com